milwaukee county wi sales tax rate

Within Milwaukee there are around 39 zip codes with the most populous zip code being 53215. The county sales tax rate of 05 is imposed on retailers making taxable retail sales licenses leases or rentals or providing taxable services in a Wisconsin county that has adopted the county tax.

U S Property Taxes Comparing Residential And Commercial Rates Across States

The most populous location in Milwaukee County Wisconsin is Milwaukee.

. Get Your First Month Free. The current total local sales tax rate in Milwaukee. The sales tax rate for Milwaukee County was updated for the 2020 tax year this is the current sales tax rate we are using in the Milwaukee County Wisconsin Sales Tax Comparison Calculator for 202223.

To review the rules in Wisconsin visit our state-by-state guide. Milwaukee Health Department Coronavirus COVID-19 updates. For assistance please call the MHD COVID Hotline 414-286-6800.

Ad DAVO Sets Aside Files Pays Your Sales Tax On Time So You Can Focus On Your Business. 4 rows Milwaukee WI Sales Tax Rate. The County sales tax rate is.

Sales tax in Milwaukee County Wisconsin is currently 56. Verification and processing of claims takes four to eight weeks. The sales tax rate does not vary based on zip code.

The Wisconsin state sales tax rate is currently. The Treasurers office will contact the claimants to inform them when their claim is completed. There is no applicable city tax or special tax.

The sales tax rate does not vary based on zip code. This includes the rates on the state county city and special levels. A full list of these can be found below.

Checks will be mailed to the address provided by the claimant in the unclaimed funds request form. The Wisconsin sales tax rate is currently. The 55 sales tax rate in Milwaukee consists of 5 Wisconsin state sales tax and 05 Milwaukee County sales tax.

And ends promptly at 1025 am. STATE COUNTY TAX RATE GROSS TAX RATE STATE CREDIT NET TAX RATE 1984. County Executive Crowley Signs 219 Million in Fiscal Health Challenge Initiatives.

9th St Room 102 Milwaukee WI 53233-1462. The minimum combined 2022 sales tax rate for Milwaukee Wisconsin is. Milwaukee County in Wisconsin has a tax rate of 56 for 2022 this includes the Wisconsin Sales Tax Rate of 5 and Local Sales Tax Rates in Milwaukee County totaling 06.

City Hall 200 E. The Milwaukee County Treasurers Office collects delinquent property taxes for 2017 and prior years and for all Milwaukee County municipalities except City of Milwaukee properties. Foreclosure sales are held on Monday at 1030 am.

Pay Delinquent Property Taxes. Milwaukee is located within Milwaukee County Wisconsin. News Events CALL for Action.

The 2018 United States Supreme Court decision in South Dakota v. 13 rows The Milwaukee County Sales Tax is 05. Has impacted many state nexus laws and sales tax collection requirements.

The average cumulative sales tax rate in Milwaukee Wisconsin is 55. If you are interested in a property included in one of the Sheriffs auctions. A county-wide sales tax rate of 05 is.

You can print a 55 sales tax table here. Real Property Sales Data. The current total local sales tax rate in Milwaukee WI is.

Wells Street Room 507 Milwaukee WI 53202 Monday - Friday 800 AM - 445 PM. Registration begins at 10 am. The county use tax rate of 05 is imposed on purchasers of items used stored or consumed in counties that impose county tax.

At the following location. The most populous zip code in Milwaukee County Wisconsin is 53215. If this rate has been updated locally please contact us and we will update the sales tax rate for Milwaukee County.

The Wisconsin sales tax is a 5 tax imposed on the sales price of retailers who sell license lease or rent tangible personal property certain coins and stamps certain leased property affixed to realty or certain digital goods or sell license perform or furnish taxable services in Wisconsin. The Milwaukee County sales tax rate is. The sales tax rate does not vary based on location.

Milwaukee County is home to over. The Milwaukee sales tax rate is. The average cumulative sales tax rate between all of them is 55.

For tax rates in other cities see Wisconsin sales taxes by city and county. Housing Resources - LWM. WI Sales Tax Rate.

Additional information is available by calling 414 278-3073 between 8 am. The Milwaukee County Board of Supervisors unanimously approved 219 million in American Rescue Plan Act funds to be allocated in one-time investments that provide long-term cost savings for Milwaukee County. What is the sales tax rate.

This is the total of state county and city sales tax rates. Milwaukee County Treasurers Office 901 N. The Milwaukee County Sheriff has real estate auctions every Monday morning on properties that are lender foreclosures due to non-payment of the mortgage.

6 rows The Milwaukee County Wisconsin sales tax is 560 consisting of 500 Wisconsin state. News Events. Access search engines showing delinquent taxes special improvement bonds tax accounts and tax data.

Wisconsin Sales Tax Rates By City County 2022

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Sales Taxes In The United States Wikiwand

Revenue Wisconsin Budget Project

Wisconsin Sales Tax Small Business Guide Truic

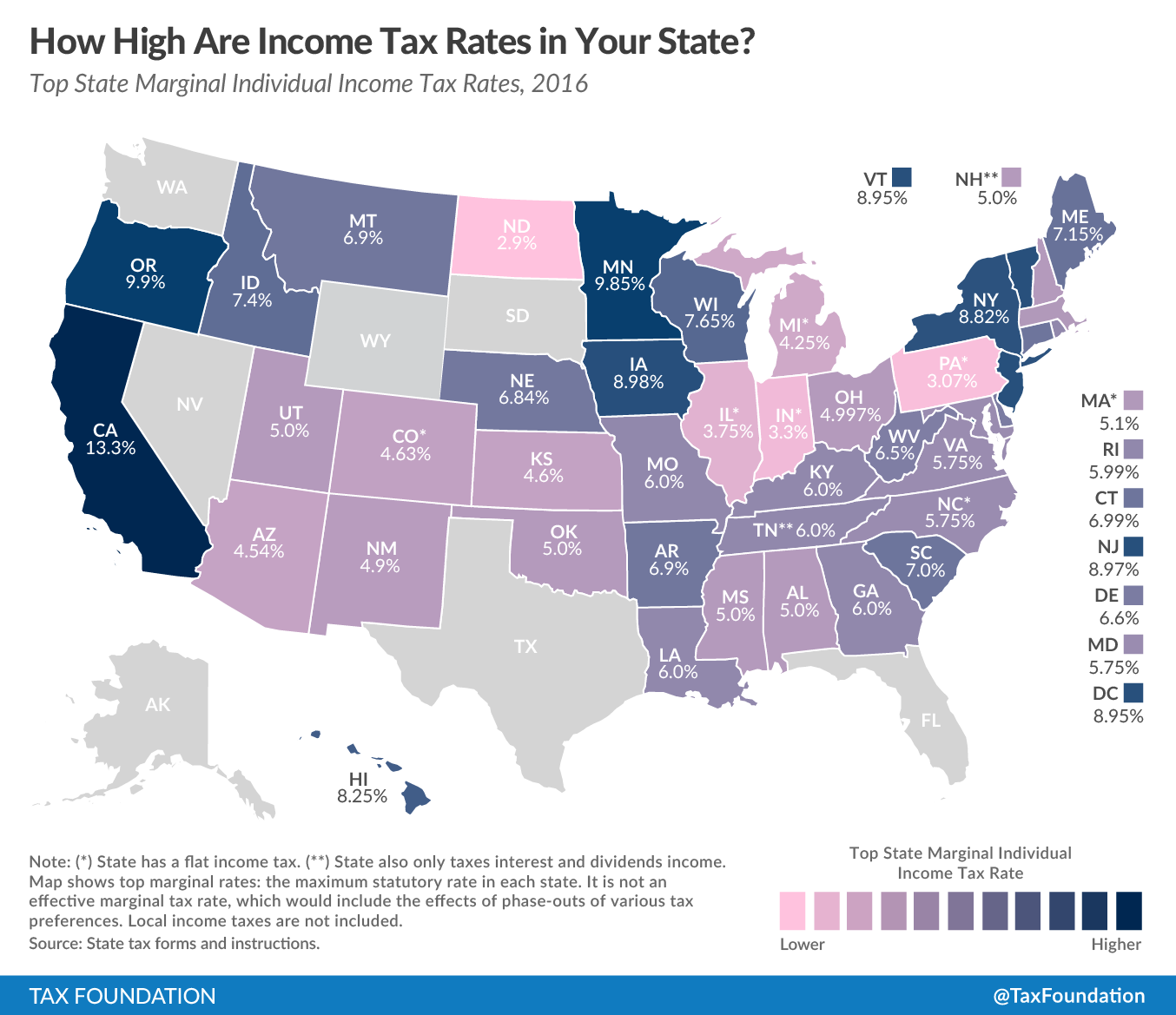

State Income Tax Rates Highest Lowest 2021 Changes

North Central Illinois Economic Development Corporation Property Taxes

Sales Tax On Grocery Items Taxjar

A Glide Path To A 3 Percent Flat Income Tax Maciver Institute

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Wisconsin Sales Use Tax Guide Avalara