does workers comp pay taxes

Generally speaking no workers comp settlements are not taxable at the federal or state level. You are not subject to claiming workers comp on taxes because you need not pay tax on income from a workers compensation act or statute for an occupational injury or sickness.

What Wages Are Subject To Workers Comp Hourly Inc

It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury tendinitis or carpal tunnel.

. But it would be smart to speak with a lawyer if youre concerned about the offset because youre eligible for both SSDI and disability benefits through workers comp. You should ask the employer to issue a new 1099-MISC to cancel out the error. However retirement plan benefits are taxable if either of these apply.

One of the silver linings of a workplace injury is state and federal taxes dont apply so theres no wincing as you look at your pay stub and see where Uncle Sam took 20 or 30 off the top. File With Confidence Today. In most states employers and employees both pay for the benefits.

There are several reasons why these benefits arent taxed. The IRS manual reads. They arent taxed for a variety of reasons one being the fact that theyre not considered earned income under current tax laws.

270 Peachtree Street NW. If an employer sends you a 1099 for workers compensation payments they made a mistake. Do You Have to Pay Taxes on Workers Comp Benefits.

However tax codes change so you should contact our office an accountant or your tax preparer to discuss the details of your situation before filing your taxes. Does workers comp count as income for your taxes. According to the IRS Publication 907 Workers Compensation for an occupational sickness or injury if paid under a.

This type of income would not be included on your tax return using the TaxAct program. In addition benefits are not taxed by most states. When you receive workers compensation benefits through the states workers compensation program they will not be taxable nor under federal or state taxes.

No you usually do not need to claim workers comp on your taxes. Amounts received as workers compensation for an occupational sickness or injury are fully exempt from tax if paid under a workers compensation act or a statute in the nature of a workers compensation act. In the metro Atlanta dialing area call 404 656-3818 and outside the metro Atlanta area call 1-800-533-0682 or write the State Board of Workers Compensation at.

Workers compensation benefits are not normally considered taxable income at the state or federal level. But here we go again if you also receive Social Security Disability benefits you may need to include a portion of your workers comp benefits on your taxes. Workers compensation benefits are not taxable by federal law.

Generally speaking workers compensation is not taxable with a few exceptions. Here are some considerations to determine whether you have to pay taxes on your workers comp. Most people wont have to pay taxes on workers comp benefits.

The lone exception arises when an individual also receives disability benefits through Social Security disability insurance SSDI or Supplemental Security Income SSI. However in some states employers only pay the tax required by law while employees only have to pay the. You dont have to pay taxes on weekly checks under workers comp.

The WCC address is. Whether you receive a lump sum payment or installments any money you receive as part of a workers compensation settlement is not subject to state or federal tax. In some cases the Social Security Administration SSA may reduce a persons SSDI or SSI so.

No Tax Knowledge Needed. Its important to be aware that SSDI or SSI payments that reduce workers compensation benefits may result in taxes. Consult with an attorney before you file.

The money you get as workers compensation benefits is generally not income that can be taxed under federal state and local income tax codes. Do you claim workers comp on taxes the answer is no. Ad TurboTax Makes It Easy To Get Your Taxes Done Right.

Whether you received wage loss benefits on a weekly basis or a lump sum settlement workers compensation is not taxable. The injury claim must be completed and transmitted by the WCC to OWCP within 10 working days after the manager receives written notice claim form from the employee. Answer Simple Questions About Your Life And We Do The Rest.

Checks are paid on a weekly basis and. In most cases they wont pay taxes on workers comp benefits. State Board of Workers Compensation.

In this case you would pay taxes on workers comp. The amount paid should equal 80 of an employees after-tax average weekly wage including overtime and discontinued fringe benefits. There will be adjustments to your disability benefits if you receive workers comp and SSDI or SSI.

This is based upon the highest 39 paid weeks out of the last 52 before the workplace accident occurred. The following payments are not taxable. Workers compensation payouts are not taxed so the employer doesnt have to create a record for the IRS by issuing a 1099.

Internal Revenue Service Workers Compensation Center 400 North 8th Street Box 78 Richmond VA 23219-4838. The State Board of Workers Compensation will provide you with Form WC-14 to file a claim. The answer is no.

The following payments are not taxable. Workers compensation for an occupational sickness or injury if paid under a workers compensation act or similar law. In general taxes on workers comp benefits are not payable at a state or federal level.

You retire due to your occupational sickness. There are three main ways to pay for workers comp in the US. IRS Publication 907 reads as follows.

Even if they do the tax should only be on a small portion of those benefits. Unless youre already receiving Social Security Disability Insurance SSDI or Supplemental Security Income SSI benefits. The quick answer is that generally workers compensation benefits are not taxable.

For one they are not considered as earned income that should be taxed. However you do not have to report workers compensation payments on your taxes. If youre injured at work and receive payments to cover your medical expenses loss of wages and painsuffering they arent taxable in most cases.

The answer is no. But like any tax situation there are exceptions to the rule you must know. There is personal income tax that is owed in all states the state sales tax that is owed and the federal income tax that is owed.

The money you get as workers compensation benefits is generally not income that can be taxed under federal state and local income tax codes.

How To Calculate Workers Compensation Cost Per Employee

%20PAYMENTS.png)

What Happens If My Job Terminates Me While I Am On Workers Comp In Sc Law Office Of Kenneth E Berger

Many People Live Paycheck To Paycheck And Missing Any Time Because Of A Workplace Accident Can Result In A Financial Dis Paying Taxes Worker Workplace Accident

While There Is Not A Specific Average Workers Comp Settlement For A Wrist Injury Most Insurance Companies Will Pay Several Ye Worker Injury Finding A New Job

Workers Compensation Archives Workers Compensation Insurance Worker Compensation

Is Workers Comp Taxable Workers Comp Taxes

Peos Have Many Benefits But One Of The Biggest Lies In Their Workers Compensation Insurance Coverage Workers Compensation Insurance Company Benefits Payroll

How Much Does An Employee Cost Infographic Patriot Software Accounting Education Entrepreneur Business Plan Check And Balance

Workers Compensation And Taxes James Scott Farrin

Work Comp Audit Do You Have To Report Workers Comp Settlements On Your Taxes Workers Compensation Insurance Worker Funeral Costs

Getting Started With Workers Compensation Insurance Workers Compensation Insurance Work Injury Workplace Injury

Everything Contractors Need To Know About Workers Comp Before Buying Workers Compensation Insurance Compensation Injured On The Job

Do I Have To Pay Taxes On My Workers Comp Benefits

Is Workers Comp Taxable Gordon Gordon Law Firm

Nanny Taxes And Payroll Services Poppins Payroll Nanny Tax Nanny Payroll Payroll

Do I Have To Pay Taxes On A Workers Comp Payout Adam S Kutner Injury Attorneys

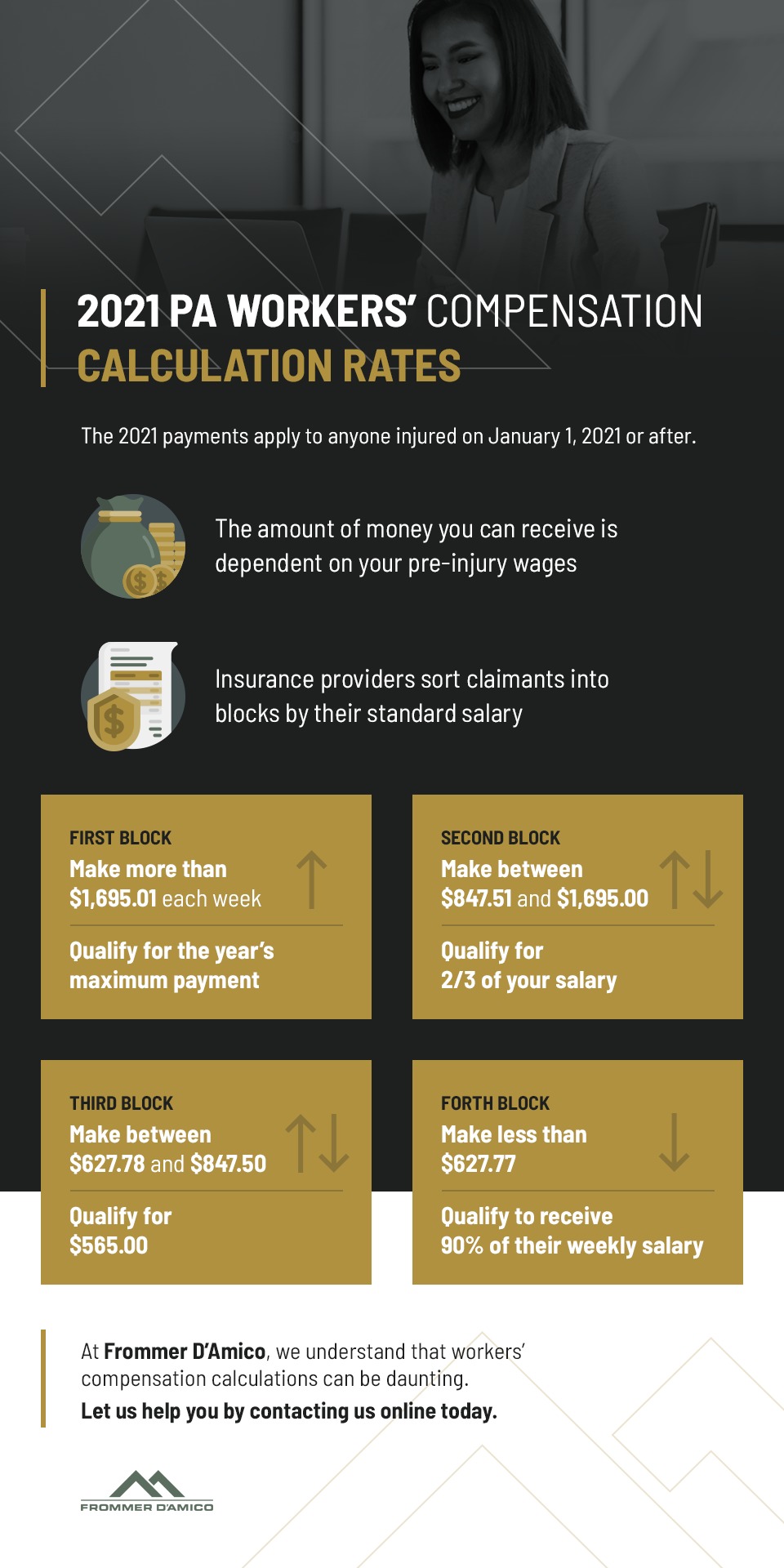

How Do I Calculate My Pa Workers Compensation Benefits

With The Tax Filing Deadline Quickly Approaching Many Are Wondering Whether They Must Pay Taxes On Their Workers C Work Injury Workplace Injury Injury Claims